Understanding the role of a Davenport County Property Appraiser is essential for anyone involved in real estate transactions, property valuation, or taxation. Whether you're a homeowner, a buyer, or a seller, knowing how property appraisal works in Davenport County can significantly impact your financial decisions. This article delves into the intricacies of property appraisal, offering valuable insights to help you navigate this complex process.

Property valuation is a cornerstone of the real estate market, ensuring fair taxation and equitable property transactions. The Davenport County Property Appraiser plays a pivotal role in this process, ensuring that property values are assessed accurately and consistently. This guide aims to provide you with a detailed understanding of the appraiser's role, the appraisal process, and how it affects you as a property owner.

As we explore the world of property appraisal in Davenport County, we'll uncover the tools, methodologies, and resources used by professional appraisers. By the end of this article, you'll be equipped with the knowledge needed to make informed decisions regarding your property's value and its implications for taxation and market positioning.

Read also:Desiremovies Win Your Ultimate Guide To Legal Streaming And Downloading

Who is the Davenport County Property Appraiser?

The Davenport County Property Appraiser is an official responsible for assessing the value of all properties within the county. This role is crucial in determining property taxes and ensuring that all properties are valued fairly and accurately. The appraiser's office conducts regular assessments and maintains records of property values, providing transparency and accountability in the valuation process.

Key Responsibilities of the Property Appraiser

- Conducting property assessments annually.

- Maintaining accurate property records.

- Providing taxpayers with information about property values.

- Handling disputes or appeals regarding property valuations.

By fulfilling these responsibilities, the Davenport County Property Appraiser ensures that the local government has a reliable basis for collecting property taxes, which fund essential public services such as schools, infrastructure, and emergency services.

Understanding the Property Appraisal Process

The property appraisal process in Davenport County involves several steps designed to ensure accuracy and fairness. Property appraisers use a combination of methodologies and data sources to determine the value of each property. Understanding this process can help property owners anticipate changes in their property values and prepare for potential tax implications.

Steps in the Appraisal Process

- Inspection: Appraisers conduct physical inspections of properties to assess their condition, size, and features.

- Data Collection: Information about recent property sales, market trends, and economic indicators is gathered to inform the appraisal.

- Analysis: Using specialized software and analytical tools, appraisers analyze the collected data to estimate property values.

- Notification: Property owners receive notices of their assessed values, along with information on how to appeal if they disagree with the appraisal.

This systematic approach ensures that property valuations are based on objective criteria and reflect current market conditions.

Factors Affecting Property Value

Several factors influence the value of a property in Davenport County. These factors are carefully considered by the property appraiser when conducting assessments. Understanding these elements can help property owners appreciate the nuances of property valuation.

Primary Factors in Property Appraisal

- Location: Properties in desirable neighborhoods or close to amenities tend to have higher values.

- Size and Features: Larger properties with unique features, such as additional bedrooms or upgraded kitchens, often command higher prices.

- Market Conditions: Economic trends, interest rates, and supply and demand dynamics impact property values.

- Condition: Well-maintained properties generally receive higher appraisals than those in need of repairs.

By considering these factors, property appraisers can provide a comprehensive and accurate valuation of each property in Davenport County.

Read also:Actor From Guardians Of The Galaxy A Comprehensive Guide To The Stellar Cast

How to Appeal a Property Appraisal

If you believe your property has been overvalued, you have the right to appeal the appraisal. The appeal process in Davenport County is designed to provide property owners with a fair opportunity to contest their assessed values. Here's how you can file an appeal:

Steps to File an Appeal

- Gather Evidence: Collect data on comparable properties, recent sales, and any factors that may affect your property's value.

- Submit a Formal Request: Complete and submit the appeal form provided by the Davenport County Property Appraiser's office.

- Attend a Hearing: Present your case before the appraisal review board, providing evidence to support your claim.

- Receive a Decision: The board will review your appeal and issue a final decision, which may result in an adjusted property value.

Appealing a property appraisal requires careful preparation and a thorough understanding of the process. Consulting with a real estate professional or attorney can help strengthen your case.

The Importance of Accurate Property Appraisals

Accurate property appraisals are vital for maintaining a fair and equitable real estate market. They ensure that property taxes are distributed fairly among homeowners and that buyers and sellers have a realistic understanding of property values. The Davenport County Property Appraiser plays a critical role in upholding these standards, contributing to the overall health and stability of the local economy.

Furthermore, accurate appraisals help prevent disputes and legal challenges, ensuring that property transactions proceed smoothly. By adhering to professional standards and utilizing advanced technologies, the appraiser's office can deliver reliable and consistent valuations.

Common Misconceptions About Property Appraisals

There are several misconceptions surrounding property appraisals that can lead to confusion among property owners. Addressing these myths can help clarify the appraisal process and its significance.

Myths vs. Facts

- Myth: Property appraisals are arbitrary and subjective.

Fact: Appraisals are based on objective data and standardized methodologies. - Myth: Appraisers consider only the property's size and age.

Fact: Appraisers evaluate a wide range of factors, including location, condition, and market trends. - Myth: Property values always increase over time.

Fact: Economic conditions and market fluctuations can cause property values to rise or fall.

By dispelling these myths, property owners can gain a clearer understanding of the appraisal process and its implications.

Tools and Technologies Used by Property Appraisers

Modern property appraisers rely on advanced tools and technologies to enhance the accuracy and efficiency of their assessments. These tools enable appraisers to gather and analyze data more effectively, resulting in more reliable property valuations.

Key Technologies in Property Appraisal

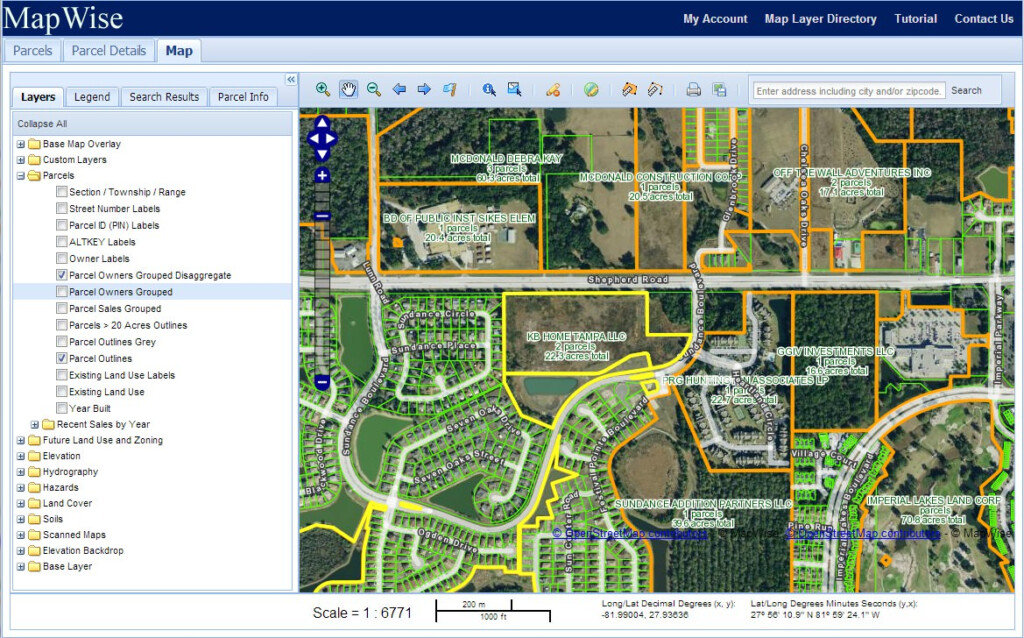

- Geographic Information Systems (GIS): Used to map property boundaries and analyze spatial data.

- Automated Valuation Models (AVMs): Software programs that estimate property values based on historical data and market trends.

- Digital Databases: Store and organize vast amounts of property information, facilitating quick and accurate assessments.

By leveraging these technologies, the Davenport County Property Appraiser can deliver timely and precise valuations, benefiting both property owners and the local government.

Impact of Property Appraisals on Taxation

Property appraisals directly influence property taxes, which are a significant source of revenue for local governments. Accurate appraisals ensure that property taxes are distributed fairly among homeowners, funding essential public services. Understanding the relationship between property appraisals and taxation can help property owners plan their finances effectively.

In Davenport County, property taxes are calculated based on the assessed value of a property, with rates determined by local government authorities. Homeowners should be aware of these rates and how they may fluctuate over time, as well as any available exemptions or deductions that could reduce their tax burden.

Future Trends in Property Appraisal

The field of property appraisal is continually evolving, driven by advancements in technology and changing market dynamics. Emerging trends in Davenport County and beyond include greater reliance on artificial intelligence, increased use of drones for property inspections, and enhanced data analytics capabilities.

Predicted Developments

- Integration of AI-driven tools to improve appraisal accuracy and efficiency.

- Expansion of remote inspection technologies, allowing appraisers to assess properties without physical visits.

- Enhanced transparency through digital platforms that provide property owners with real-time access to appraisal data.

These innovations promise to revolutionize the property appraisal process, making it faster, more accurate, and more accessible to all stakeholders.

Conclusion

In conclusion, the Davenport County Property Appraiser plays a vital role in maintaining a fair and transparent real estate market. By understanding the appraisal process, the factors influencing property values, and your rights as a property owner, you can better navigate the complexities of property valuation and taxation.

We encourage you to take action by reviewing your property's assessed value, exploring available resources, and staying informed about developments in the field of property appraisal. Share this article with others who may benefit from its insights, and consider exploring additional content on our website for further guidance on real estate-related topics.

Table of Contents

- Who is the Davenport County Property Appraiser?

- Understanding the Property Appraisal Process

- Factors Affecting Property Value

- How to Appeal a Property Appraisal

- The Importance of Accurate Property Appraisals

- Common Misconceptions About Property Appraisals

- Tools and Technologies Used by Property Appraisers

- Impact of Property Appraisals on Taxation

- Future Trends in Property Appraisal

- Conclusion